oklahoma franchise tax return form

Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999 First Step. Up to 25 cash back See the IRS website for the form Unlike the default pass-through tax situation when an LLC elects to be taxed as a corporation the company itself must file a separate tax return.

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Form 200 - Page 5 First Step.

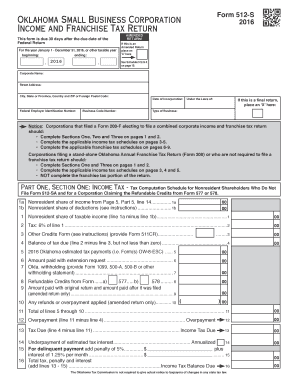

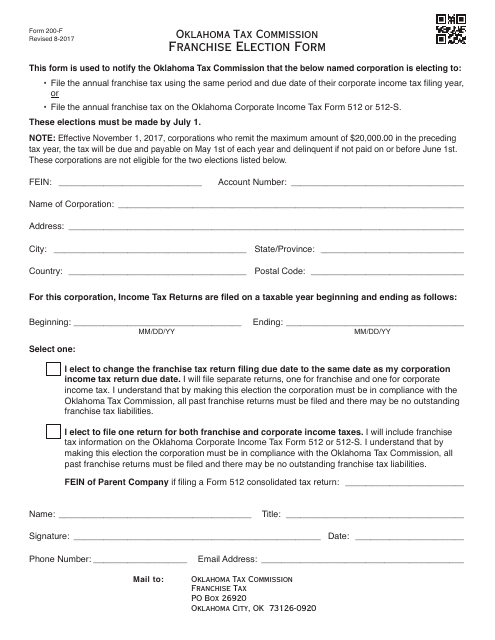

. 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma On average this form takes 151 minutes to complete The 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma form is 48 pages long and contains. To make this election file Form 200-F. Corporations filing a stand-alone Oklahoma Annual Franchise Tax Return Form 200 or who are not required to file a franchise tax return should.

Oklahoma Tax Commission with each report submitted. Individual filers completing Form 511 or 511NR should use Form. Mail your 2020 tax payment and Form EF-V to.

Time for Filing and. All forms are printable and downloadable. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

To make this election file Form 200-F. Foreign not-for-profit corporations however are still required to pay the 10000 registered agent fee. Prepare and file your Oklahoma Annual Franchise Tax Return and provide the businesss FEIN.

Complete Balance Sheet and Schedules B C D Must be returned with annual return Line 1Line 1 through 3 cash notes accounts receivable and inventories are to be reported at book value. Tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. Use Get Form or simply click on the template preview to open it in the editor.

Once completed you can sign your fillable form or send for signing. Franchise Tax Payment Options New Business Information New Business Workshop. Select Popular Legal Forms Packages of Any Category.

Submit separate Form 512 pages 6 9 for each company within the consolidation. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return. Visit us at taxokgov to file your Franchise Tax Return Officer Listings Balance Sheets and Franchise Election Form Form 200-F.

The State of Oklahoma like almost every other state has a corporation income tax. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. These elections must be made by July 1.

Oklahoma Annual Franchise Tax Return State of Oklahoma Form Use Fill to complete blank online STATE OF OKLAHOMA OK pdf forms for free. Start completing the fillable fields and carefully type in required information. Not-for-profit corporations are not subject to franchise tax.

Download OTC Form 200-F Franchise Election Form Oklahoma File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S. These elections must be made by July 1. Quick steps to complete and e-sign Oklahoma franchise tax instructions 2021 online.

Form 200-F must be filed no later than July 1. LLCs are statutorily exempt from. Complete Sections One and Three on pages 1 and 2.

Please put your FEIN on your check. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 18 25 of Form 512. When submitting the Franchise Tax Return foreign corporations must pay a 100 registered agensts fee.

All regular corporations and subchapter-S corporations are required to file Form 200 Annual Franchise Tax Return and pay franchise tax. NOT have remitted the maximum amount of franchise tax for the preceding tax year. Fill out and file Schedule A which provides the name and contact information for the businesss officers.

To make this election file Form. Forms - Business Taxes Forms - Income Tax Publications Exemption Letters All Taxes Income - Individual Income - Businesses Motor Vehicles Gross Production Online Registration Reporting Systems Rates Rebates. Franchise Tax Computation The basis for computing Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of the last preceding.

The use of the correct corporate name and Federal Employer Identification Number on your return and all correspondence will facilitate processing and handling. Special Instructions Regarding Form 512 Page 5. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual.

File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S. Tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. You may file this form online or download it at wwwtaxokgov.

Applications for refunds must include copies of your related Oklahoma Income Tax Returns. To make this election file Form 200-F. Complete the applicable franchise tax schedules on pages 6-9.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma. Complete Balance Sheet and Schedules B C D Must be returned with annual return Line 1 through 3 Cash notes accounts receivable and inventories.

Acquired by the nature of all organizations falling within the purview of the Franchise Tax Code. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Who to Contact for Assistance For franchise tax assistance call the Oklahoma Tax Commission at 405 521-3160.

Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. Oklahoma Tax Commission PO Box 26890 Oklahoma City OK 73126-0890. Mandatory inclusion of Social Security andor Federal Employers Identification numbers is required on forms filed with the Oklahoma Tax.

File return payment balance sheet and schedules with the businesss FEIN or EIN. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Corporations electing to file a combined income and franchise tax return should use this form when the Total Balance Due is income tax franchise tax or both.

In Oklahoma the corporate tax is a flat 6 of Oklahoma taxable income. Complete OTC Form 200-F. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

All Major Categories Covered. Fill Online Printable Fillable Blank Form 200.

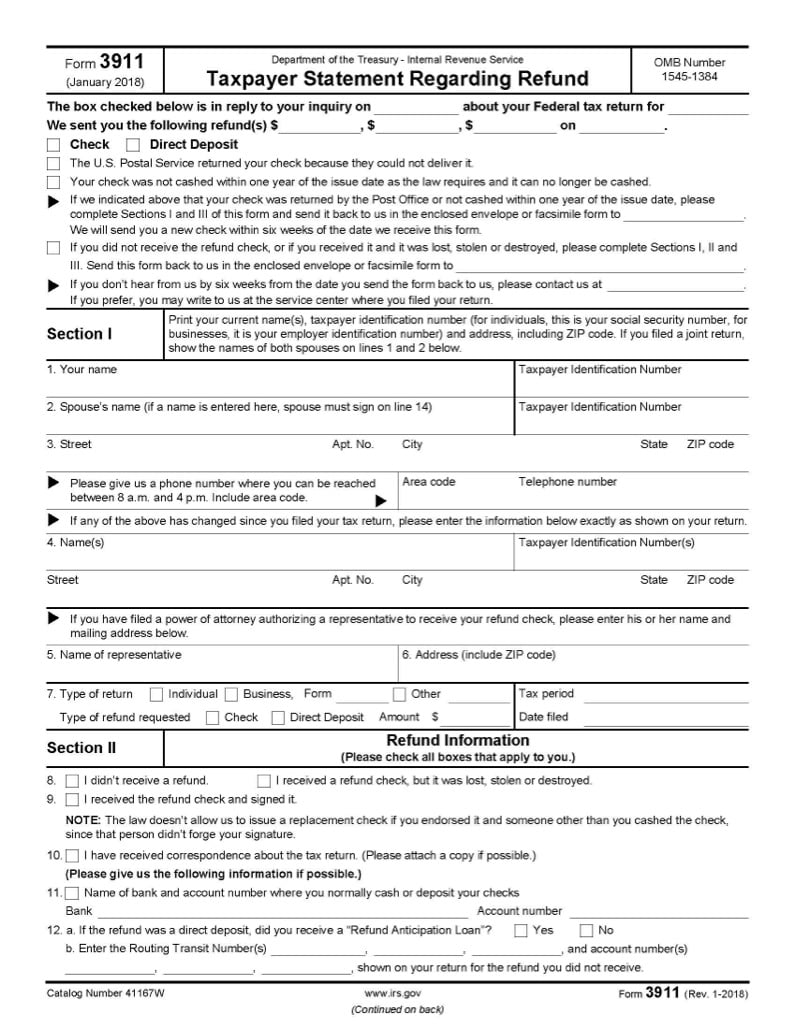

Form 3911 Never Received Tax Refund Or Economic Impact Payment

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Filing A Schedule C For An Llc H R Block

Work For Hire Agreement Template Sample Work For Hire Agreement Limited Partnership

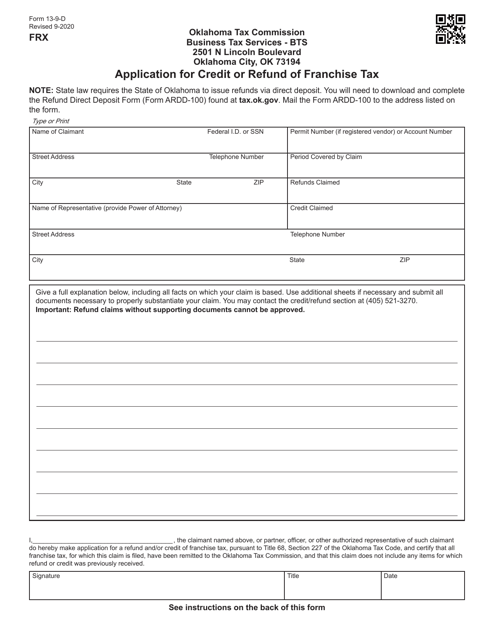

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Comics

Fillable Online Form 512 S Fax Email Print Pdffiller

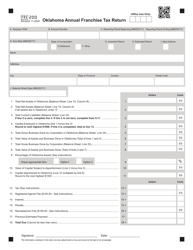

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Here Are Some Last Minute Tips As The April 18 Tax Filing Deadline Nears

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

Top Earning Estates For 2019 Estate Planning Attorney Estate Planning Attorney At Law

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Work For Hire Agreement Template Sample Work For Hire Agreement Limited Partnership

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)